EVERY PORTFOLIO IS UNIQUE – JUST AS OUR INVESTORS | RISK APPETITE, LIQUIDITY PREFERENCES, AND RETURN EXPECTATIONS MET BY INDIVIDUAL INVESTMENT APPROACHES.

We understand investors’ portfolio allocations in their entirety. When developing real estate investment strategies, we use a holistic approach to the individual portfolio strategy of each investor.

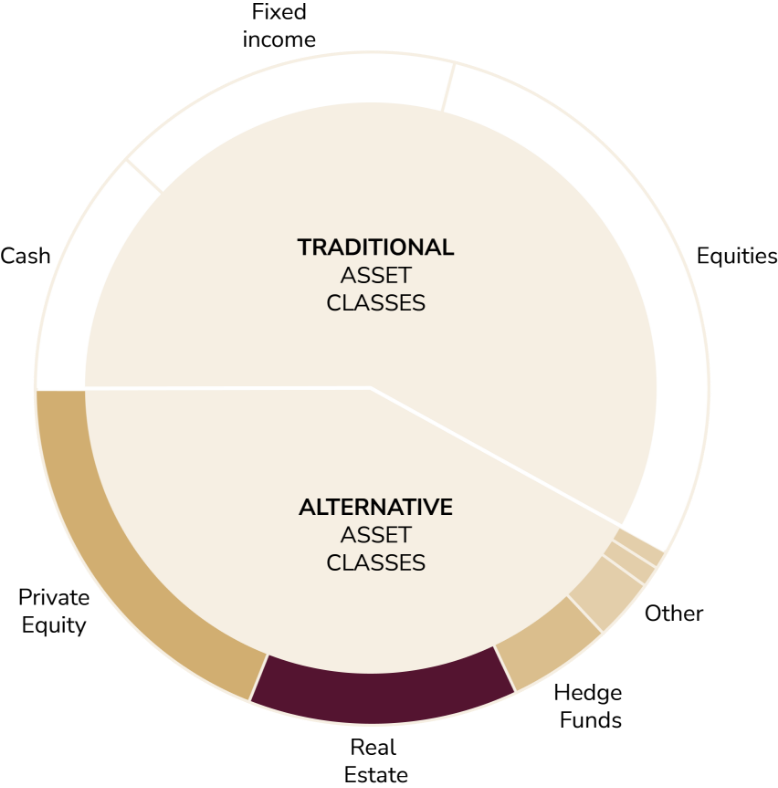

Diversification means a well levelled combination of wealth-preserving and wealth-maximising investment strategies within different types of real estate assets and markets. From an overall asset allocation perspective, real estate ideally complements liquid and other asset classes by reducing the overall portfolio risk while optimising returns.

Low-risk investment strategies in core and core+ real estate focusing on optimising long-term operating cash flow. A rigorous deal sourcing and due diligence process focusing on sustainable investment criteria such as high-quality location, investment grade tenancy, and a property quality which meets relevant environmental standards. Income return strategies secure a sustainable distribution profile which from a portfolio perspective complements our Total Return strategies.

SOLUTIONSPrivate-equity-like investment strategies in value add and opportunistic real estate with a bottom-up asset management approach. “Alpha” is actively created through simultaneous optimisation of all relevant value drivers using NAS Invest’s in-house experience. As an active investment and asset manager, we stay committed to our investments and investors. Therefore, NAS Invest operates not only on performance-based remuneration but also co-invests side by side with its investors.